Processing of 2023 Kentucky returns will begin February 5, 2024

Understanding The Refund Process

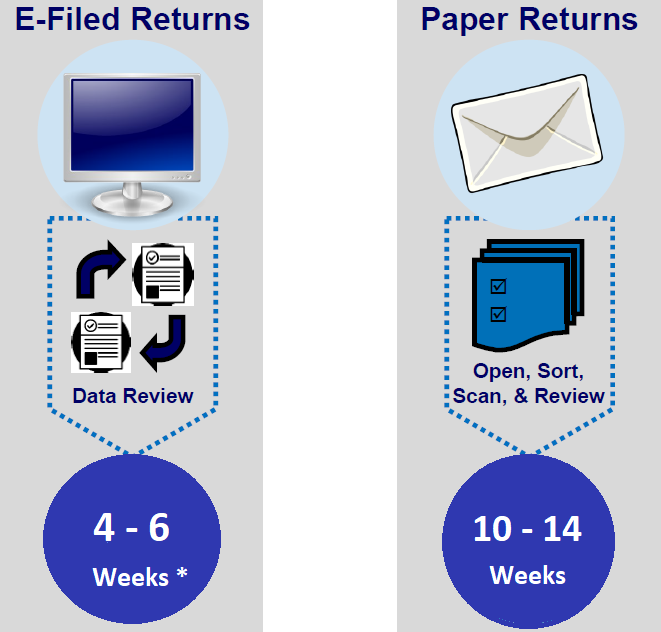

* Direct Deposit only. Allow an additional week for paper check requests.

Error correction will require additional time to process and may result in the issuance of a paper check in lieu of a direct deposit where applicable.

The Kentucky Department of Revenue offers additional information regarding the processing and status of your refund request. You may use the tool below for the most current status of your current year original return.

Check Refund Status Online (Current Year Original Only)

To obtain a previous year(s)

refund status, please call (502) 564-4581 to speak

to an examiner. Prior year and amended return processing may require in excess of 20 weeks to complete.

Protecting You Against Tax Fraud:

The Department of Revenue takes identity fraud very seriously. If any of your information (address, bank account, etc.) changed since last year, there may be additional security steps to verify your identity to protect you and the Commonwealth. This may result in extended refund processing times.

Report Tax Fraud

Return Adjustments:

If your tax return was adjusted and you would like to provide additional documentation for review you may mail to:

Kentucky Department of Revenue

Taxpayer Assistance

PO Box 181 Station 56

Frankfort, KY 40601

Or via fax: 502-564-3392.

Kentucky Department of Revenue

Taxpayer Assistance

PO Box 181 Station 56

Frankfort, KY 40601

Or via fax: 502-564-3392.